Publicly Traded Graphene Companies in 2026

Graphene is transitioning from laboratory research into commercial reality. Investors seeking exposure often ask which graphene companies are publicly traded and how they differ.

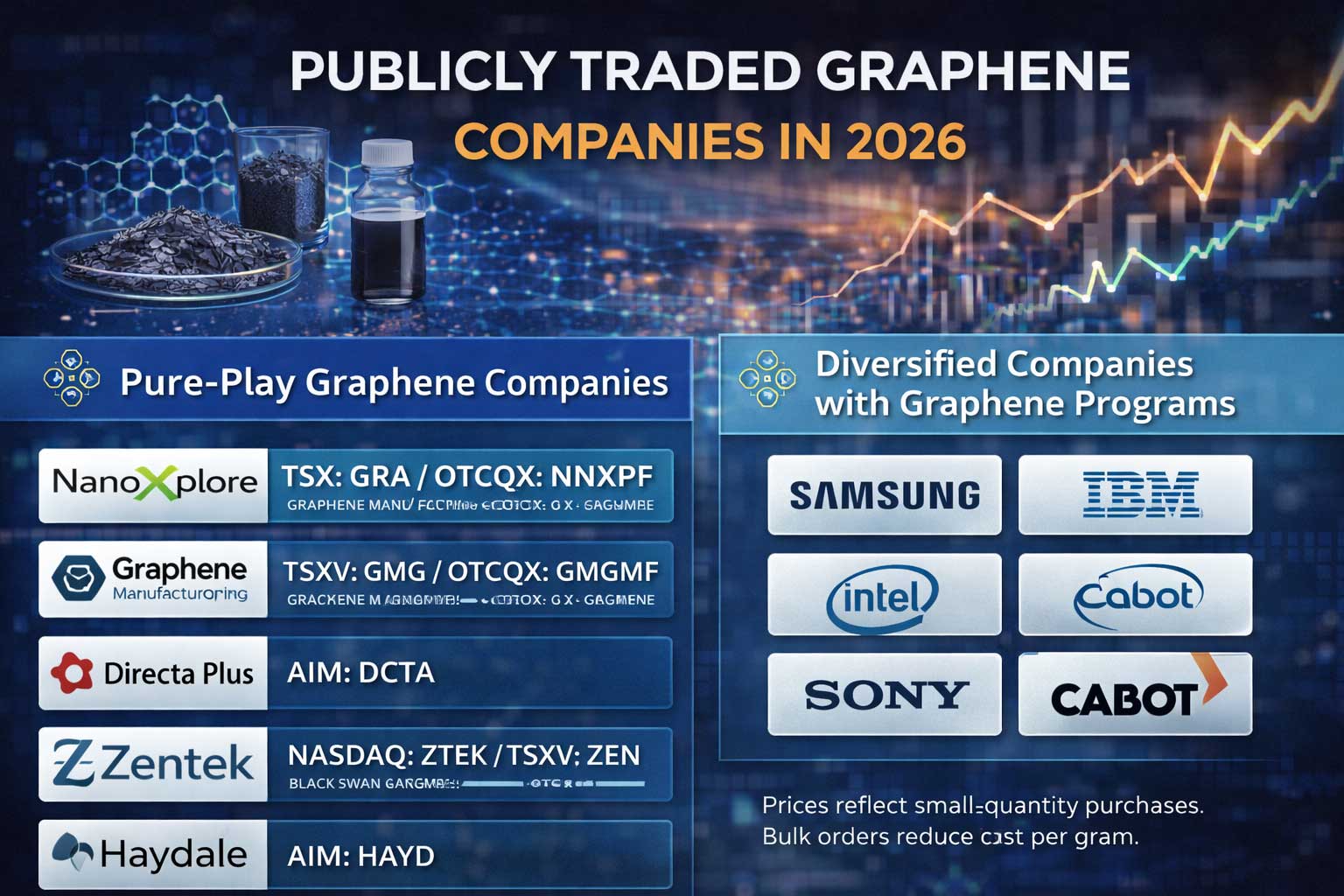

In 2026, the graphene market is defined by two groups: pure-play graphene firms and diversified corporations with graphene programs. Each offers a different risk and reward profile.

Pure-Play Graphene Companies

These companies focus primarily on graphene production and applications, offering the most direct exposure to the sector.

- NanoXplore (TSX: GRA / OTCQX: NNXPF) – Large-scale graphene powder producer serving automotive and industrial markets.

- Graphene Manufacturing Group (GMG) (TSXV: GMG / OTCQX: GMGMF) – Develops graphene for thermal coatings and next-generation batteries.

- Directa Plus (AIM: DCTA) – Produces graphene nanoplatelets for textiles, tires, and environmental solutions.

- Zentek (NASDAQ: ZTEK / TSXV: ZEN) – Focuses on graphene oxide coatings for filtration and antimicrobial uses.

- Black Swan Graphene (TSXV: SWAN / OTCQX: BSWGF) – Expands bulk graphene for polymers and composites.

- Haydale Graphene Industries (AIM: HAYD) – Supplies functionalized graphene for composites, inks, and electronics.

Diversified Companies With Graphene Programs

These firms are not graphene-only, but they invest in graphene research and products as part of broader portfolios.

- Samsung – Graphene research for semiconductors and batteries

- IBM – Advanced materials and graphene electronics research

- Intel – Exploring graphene for future chip technologies

- Sony – Integrating graphene into sensors and imaging

- Cabot Corporation – Specialty materials including graphene-enhanced composites

How These Companies Differ

- Pure-play firms: Higher growth potential, higher volatility

- Diversified firms: Lower risk, graphene is a small revenue component

What Investors Look For

- Commercial traction and real customers

- Scalable production methods

- Strong patents and intellectual property

- Partnerships with major manufacturers

- Clear application focus (coatings, batteries, composites, filtration)

The 2026 Landscape

Graphene remains an emerging industry. Many public graphene firms are early-stage and pre-profit, reflecting the long adoption curve of advanced materials.

Rather than a single winner, the market is likely to produce specialized leaders across different applications—coatings, energy storage, composites, and filtration.

Frequently Asked Questions

Are there many public graphene companies?

No. The sector is still small, with only a handful of pure-play public firms.

Are graphene stocks risky?

Yes. Most are early-stage and volatile.

Do big tech firms rely on graphene?

They research and test it, but it is a small part of their businesses.

Is graphene investing long-term?

Yes. Most applications are still developing.

Will one company dominate graphene?

Unlikely. Different companies will lead in different applications.